After independence, a quasi-federal Constitution was adopted in India with centralizing tendencies; the Constitution provides for a division of responsibilities between the Union (or Centre) and States with regard to various areas of governance. There is a Union List, a State List and a Concurrent List enumerating the division of power to legislate on different subjects as well as the power of revenue collection and areas of public expenditure.

In terms of division of powers and responsibilities, the Union List mainly covers matters of national importance (such as defence, transportation, infrastructure, international trade and macroeconomic management etc.). As per the provisions made in the State List, States are given regional matters and issues considered to be more important at the State level (such as law and order, public health, housing, agriculture etc.). The Concurrent List includes a number of sectors (such as education, contracts, matters of bankruptcy and insolvency, employment and labour welfare, electricity etc.), each of which requires consensus between the Union and States.

Sanitation clearly falls within the State List. Water, “that is to say, water supplies, irrigation and canals, drainage and embankments, water storage and water power”, is also a part of the State List. However, “regulation and development of inter-State rivers and river valleys …” appears in the Union List.

Starting from the 1960s, the Union Government has also been carrying out programmatic interventions in a number of areas that fall either in the Concurrent List (e.g. education) or in the State List (e.g. public health and sanitation) in the interest of addressing issues that are of national importance.

While several State Governments and experts have been critical of this development, referring to it as over-centralization of policy and programming across sectors, the concerns of regional disparity in the country on the other hand seem to justify the Union Government’s approach. This debate continues to draw attention in India’s policy and public finance landscape till date. As far as provisioning of safe drinking water and sanitation facilities is concerned, the programmes / schemes launched by the Union Government (known as Central Schemes) have been the backbone of public service delivery in this sector in many of the relatively poorer States.

The division of roles and responsibilities between the Union Government and State Governments, given in the Constitution, has translated into a division of expenditure responsibilities and taxation powers between the two. However, there is a vertical imbalance between the powers of the States and that of the Union to raise revenue through taxes and duties in comparison to their respective expenditure requirements. The powers of revenue mobilization vested with the States are insufficient to help them mobilize enough resources to meet their total expenditure requirements. This kind of a vertical imbalance was built into the fiscal architecture of India keeping in mind the need for Union Government’s interventions to address the horizontal imbalance, i.e. the limited ability of some of the States to mobilize adequate resources from within their State economies compared to other States. In the fiscal architecture that has evolved in India, a significant amount of fiscal resources are transferred from the Union Government every year to State Governments so as to enable them to meet their expenditure requirements.

A Finance Commission is set up once every five years to recommend on sharing of fiscal resources between the Union and the States, a major part of which pertains to sharing of revenue collected in the Central Tax System. The total amount of revenue collected from all Central taxes – excluding the amount collected from Cesses, Surcharges and taxes of Union Territories, and an amount equivalent to the cost of collection of Central Taxes – is considered as the shareable / divisible pool of Central tax revenue. In the recommendation period of the 13th Finance Commission (2010-11 to 2014-15), 32 percent of the divisible pool of Central tax revenue used to be transferred to States every year, which was increased to 42 percent by the 14th FC (for 2015-16 to 2019-20).

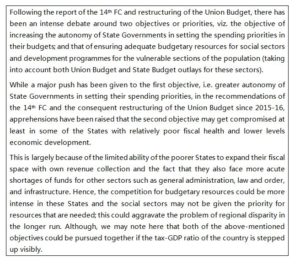

Box 1: Debate Following the 14th FC Recommendations and

Restructuring of Centre-State Sharing of Resources for the Period 2015-16 to 2019-20

Following the report of the 14th FC and restructuring of the Union Budget, there has been an intense debate around two objectives or priorities, viz. the objective of increasing the autonomy of State Governments in setting the spending priorities in their budgets; and that of ensuring adequate budgetary resources for social sectors and development programmes for the vulnerable sections of the population (taking into account both Union Budget and State Budget outlays for these sectors).

While a major push has been given to the first objective, i.e. greater autonomy of State Governments in setting their spending priorities, in the recommendations of the 14th FC and the consequent restructuring of the Union Budget since 2015-16, apprehensions have been raised that the second objective may get compromised at least in some of the States with relatively poor fiscal health and lower levels economic development.

This is largely because of the limited ability of the poorer States to expand their fiscal space with own revenue collection and the fact that they also face more acute shortages of funds for other sectors such as general administration, law and order, and infrastructure. Hence, the competition for budgetary resources could be more intense in these States and the social sectors may not be given the priority for resources that are needed; this could aggravate the problem of regional disparity in the longer run. Although, we may note here that both of the above-mentioned objectives could be pursued together if the tax-GDP ratio of the country is stepped up visibly.

This increase in devolution to States has been accompanied by some reductions in the Union Government’s / Centre’s direct funding of several social sector programmes; State Governments are expected to compensate for the reductions in the Central share of funding in such programmes depending on their State-specific needs across sectors. This has emerged as one of the important issues in public financing of WATSAN services, especially in the relatively less developed States. Hence, it is pertinent to analyse whether the overall quantum of budgetary resources flowing into WATSAN sector (i.e. the resources provided for Central Schemes, with combined Central and State shares for such schemes, and those provided for State Government’s own schemes for the sector) has increased in the 14th FC period or not. Moreover, given the high degree of political priority given to sanitation with the Swachh Bharat Mission (SBM) since 2014, which is a Central Scheme for sanitation, it is also important to study the spending priorities for drinking water vis-à-vis those for sanitation in the most recent years.

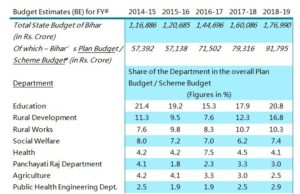

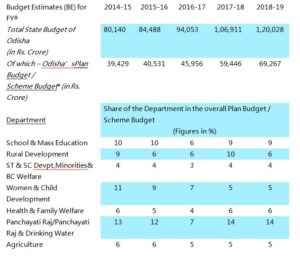

Table 1 and Table 2, in the following, depict the trends in the sector-wise / Department-wise priorities in Bihar and Odisha’s State Budgets during the 14th FC years (i.e. 2015-16 onwards), respectively. In this analysis, only select Departments are covered, all of which are directly relevant for public provisioning for the poor and underprivileged sections of the population.

We find a significant increase (in absolute or nominal figures) in the overall magnitude of the State Budget of Bihar during the years 2015-16 to 2018-19. The volume of the Plan Budget or Scheme Budget[1] of the State has also registered a similar expansion over the last four financial years (FYs). Among the eight selected Departments, all of which fall broadly under social sectors, Rural Development and Rural Works departments have witnessed noticeable increases in their respective shares in the overall Plan Budget / Scheme Budget of Bihar during the 14th FC years.

In the case of Odisha, we find a gradual increase (in absolute or nominal figures) in the overall magnitude of the State Budget of Odisha during the FY years 2015-16 to 2018-19. The volume of the Plan Budget or Scheme Budget of the State has also registered a healthy increase from 2014-15 to 2018-19. Among the seven selected Departments, all of which fall broadly under social sectors, none of the departments has witnessed any increase in the respective share in the overall Plan Budget / Scheme Budget of Odisha during the 14th FC years except for the Department of Panchayati Raj and Drinking Water. In fact, the share of the Women and Child Development Department has reduced significantly from 2014-15 to 2018-19.

Table 1: Department-wise Priorities in State Budgets of Bihar over the 14th FC Period

Notes:

@ The figures for percentage shares of various Departments in the total Plan Budget / Scheme Budget of Bihar are provided every year in the State Budget documents only for the Budget Estimates (BE) for the ensuing financial year (FY). Such figures for the Revised Estimates for the ongoing FY or Actual Expenditures for the previous FY are not given in the State Budget documents.

#Until FY 2016-17, Bihar’s Total State Budget was presented along with a Plan vs. Non-Plan break up. This distinction was dropped by the Union Government and most States in FY 2017-18. However, starting with FY 2017-18, Bihar State Budget documents provide a similar break up, viz. Scheme ExpenditureVs. Establishment and Committed Expenditure. The erstwhile Plan Budget of Bihar broadly matches with the Scheme Expenditure / Scheme Budget, while the erstwhile Non-Plan Budget corresponds broadly to the Establishment and Committed Expenditure / Budget.

Source: Compiled from Budget Summary, State Budget of Bihar, various years.

The ones that provide budgetary resources for WATSAN programmes in rural areas in Bihar are Public Health Engineering Department (PHED) and Panchayati Raj Department (PRD). We find a steep decline in the budgetary priority (within the Plan / Scheme Budget of the State) for each of them in 2015-16 (i.e. the first FY in 14th FC’s recommendation period) compared to the year before; but we also notice a restoration of budgetary priority for these departments in FYs 2017-18 and 2018-19. In fact, in the State Budget for 2018-19, PHED has registered an increase in its share to 2.9 percent of the overall Scheme Budget from 2.5 percent in the year before.

Table 2: Department-wise Priorities in State Budgets of Odisha over the 14th FC Period

Notes:

@ The figures for percentage shares of various Departments in the total Plan Budget / Scheme Budget of Bihar are provided every year in the State Budget documents only for the Budget Estimates (BE) for the ensuing financial year (FY). Such figures for the Revised Estimates for the ongoing FY or Actual Expenditures for the previous FY are not given in the State Budget documents.

#Until FY 2016-17, Odisha’s Total State Budget was presented along with a Plan vs. Non-Plan break up. This distinction was dropped by the Union Government and most States in FY 2017-18. However, starting with FY 2017-18, Odisha State Budget documents provide a similar break up, viz. Scheme ExpenditureVs. Establishment and Committed Expenditure. The erstwhile Plan Budget of Bihar broadly matches with the Scheme Expenditure / Scheme Budget, while the erstwhile Non-Plan Budget corresponds broadly to the Establishment and Committed Expenditure / Budget.

Source: Compiled from Budget at a Glance, State Budget of Odisha, various years.

The department that provides budgetary resources for WATSAN programmes in rural areas in Odisha is the Panchayati Raj and Drinking Water Department (PR &DW). We find a slight increase in the budgetary priority (within the Plan / Scheme Budget of the State) for it in 2017-18 (i.e. the third FY in 14th FC’s recommendation period) compared to the years before; although we also notice a very significant decline of budgetary priority for the department in FY 2016-17. This clearly shows that the States’s budgetary priority reduced for water and sanitation during that time time period most probably due to the increased budgets from the Union government.

In 1992, a major process of fiscal decentralization was initiated in the country, through the 73rd and 74th Constitution Amendment Acts, to empower Local Governments in terms of their revenue and spending capacity. After these amendments, State Governments evolved their own rules for devolving fiscal power to Local Governments and the extent of devolution was left to the States to decide according to local needs; as a result, it has varied widely across States.

As far as the role of rural Local Governments in WATSAN sector is concerned, it was noted earlier that the 14th FC has also provided a visibly higher quantum of grants (compared to the earlier FCs) for the GPs. Thus, the volume of funds flowing to GPs in Bihar and Odisha would certainly have gone up visibly during the 14th FC years. However, the role that GPs can play in public financing of WATSAN services also depends on the extent of devolution of functions, funds and functionaries to Panchayati Raj Institutions (PRIs) in the State.

As stated at the outset, State Governments and Local Governments (especially the GPs) are playing a more prominent role currently in public financing of the programmes delivering WATSAN services in rural areas in the country. Hence, it is important to examine the expenditure priorities for drinking water and sanitation in the State Budgets of Bihar and Odisha, and how the 14th FC funds are being spent at the level of GPs in the State in the most recent years.

[1]The Plan Budget or Scheme Budget, to put it simply, is that part of a State Budget where the Government provides budgetary resources for ongoing / new projects for socio-economic development. The Non-Plan Budget mostly caters to the State Government’s establishment and committed expenditure across sectors. A part of Non-Plan expenditure too is meant for development purposes (e.g. expenditure on salaries of all regular / permanent government staff in school education, higher education, medical and public health, agriculture sector etc.); however, the State Government gets very little maneuverability or flexibility for reducing or increasing expenditures quickly in this part of the Budget. Hence, policy analysts as well as policymakers usually observe the spending priorities in the Plan Budget / Scheme Budget, which finances all kinds of ongoing / new projects for socio-economic development in the State.

This brief note is written by Subrat Das to support capacity building of civil society organisations in tracking and analysing budgets for water and sanitation sector. The author is grateful to Trisha Agarwala and Jawed Alam Khan at CBGA for valuable inputs for this piece. It is also available on: https://www.ircwash.org/resources/india%E2%80%99s-fiscal-policy-framework-and-its-implications-water-and-sanitation.

31 May 2019

31 May 2019