Removing Cascading Effect of Taxes: GST

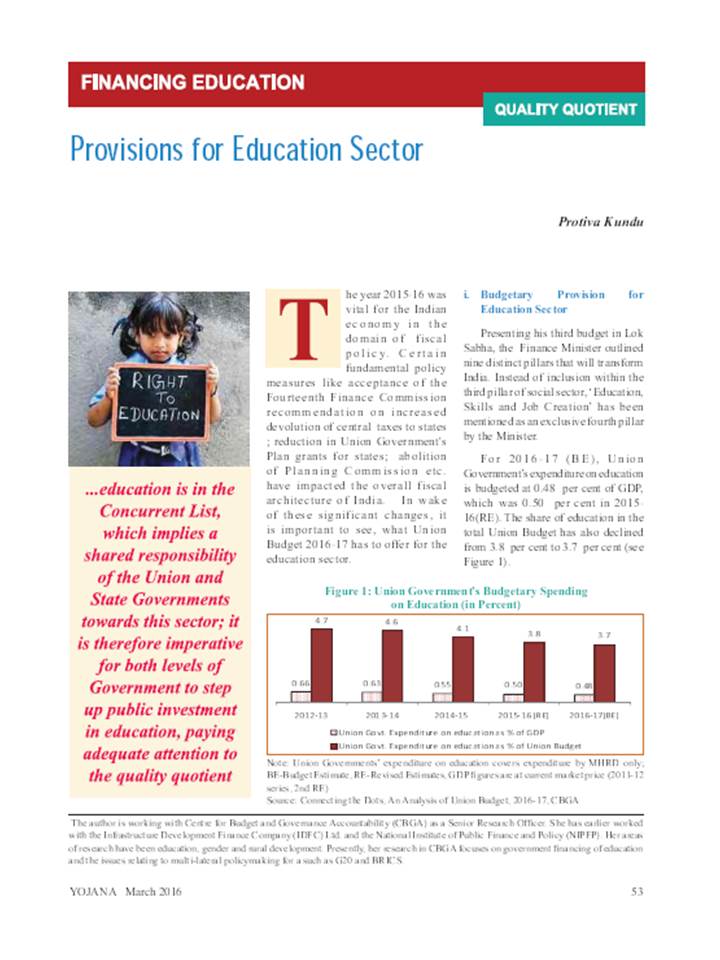

Based on who pays and how it is collected, taxes are divided into two categories – Direct Tax and Indirect Tax. Generally levied on Income, Profit or Wealth, some examples of direct taxes are Income Tax, Corporation Tax, Wealth Tax and Property tax.In contrast, Indirect taxes are levied on the transactions of goods or services and can be borne either by the seller or by the buyer, however the sellers can and in most cases do pass it on to the buyers. Some examples of indirect taxes are – custom duty on foreign import of goods, service tax on the service provided by a commercial entity, excise duty on the manufacturing of goods, sales tax on the goods being sold and so on.Goods and Services Tax (GST) is an indirect tax which will replace almost all other indirect taxes levied by central and state governments.