The much expected Interim Union Budget 2019-20 was presented on 1 February, 2019 and a number of major announcements were made, with new schemes being introduced, ranging from a small income guarantee scheme to farmers having less than 2 hectares landholding, to a new contributory pension scheme for unorganised sector workers earning less than Rs. 15,000 per month.

On the tax front too, the finance minister made a number of announcements, the most important being the tax rebate given to individual taxpayers having taxable annual income up to Rs 5 lakhs so that they will no longer be required to pay any income tax. This, as the budget speech mentions, would provide relief to about 3 crore middle-class taxpayers.

This would also cost the government about Rs 18,500 crore. The cost to the exchequer on account of this rebate amounts to nearly 3 percent of the revenue forecasted for personal income tax in the Budget estimate (BE) for 2019-20. This outgo notwithstanding, the tax revenue on account of personal income tax is expected to grow by a whopping 17 percent in 2019-20 (BE) compared to the revised estimate (RE) for the previous budget.

An analysis shows that tax revenue forecasted in the year budget is presented often tends to be different from the actual revenue generated. While actual figures provide a clearer picture about how revenue generation has fared compared to what was estimated, the revised estimates of the previous year also provide some indication whether budget estimates for the next year are ambitious or realistic.

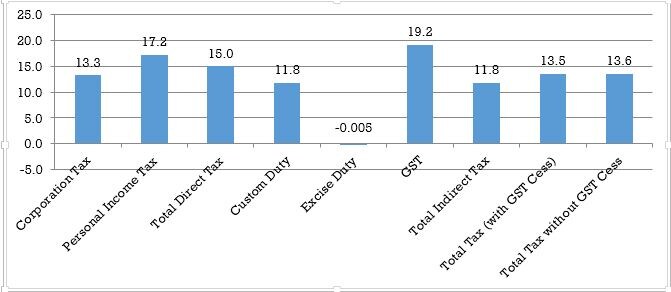

As the figure below shows compared to 2018-19 (RE), direct tax collection in 2019-20 (BE) is expected to grow by 15 percent. And within direct taxes, the larger growth is expected to occur in personal income tax. It is not clear how personal income tax can grow at such a high rate, given that what the government managed to earn on this account in 2018-19 (RE) is not much higher than what it had forecasted (2018-19 BE) and in 2019-20 there is also an additional tax outgo of Rs. 18,500 crore on account of the rebate given to personal income taxpayers.

Figure: Growth in Different Component of Taxes in 2019-20 (BE) vs. 2018-19 (RE) (in percent)

Source: Interim Union Budget 2019-20

But what is perhaps most telling is what has happened in revenue generated under the Goods and Services Tax (GST) component of taxes in 2018-19 (RE) and the forecast made for 2019-20. Data shows that there has been a shortfall of Rs. 1,00,000 crore in GST revenue earned in 2018-19 (RE) compared to what was forecasted in 2018-19 (BE).

In fact, many analysts had pointed out that GST revenue collection projected in 2018-19 (BE) was extremely ambitious. The revised figures for 2018-19 make it clear that they were indeed ambitious. Given the huge shortfall in GST revenue, it does seem odd that the projections for 2019-20 (BE) are what it is. No doubt, the projected figure for 2019-20 (BE) is not very different from what was projected in 2018-19 (BE). But when compared to the revenue earned in 2018-19 (RE) figures, the projected GST revenue growth of more than 19 percent does seem extremely ambitious.

It can, of course, be argued that a shortfall in GST revenue in the financial year 2018-19 was to be expected given that GST rates have been brought down for several items during this period. But the cut in tax rates explains only one part of the story underlying this shortfall. The other reason that can account for the huge shortfall in GST revenue (and one that is less discussed) is that of the almost-steady decline in compliance among enterprises/entities registered under GST.

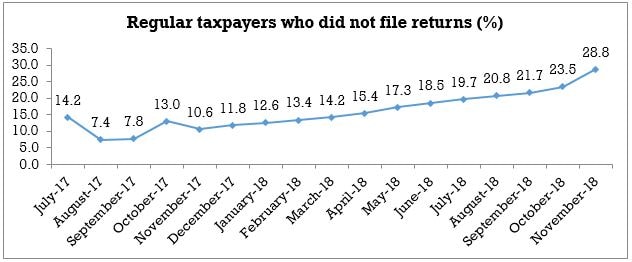

As the figure below shows the proportion of entities not filing returns (and hence not depositing the required taxes) as the share of a total number of entities registered under GST, has increased steadily over the period beginning from July 2017 to the November 2018.

Source: Un-starred question number 4063, Lok Sabha, 4 January, 2019

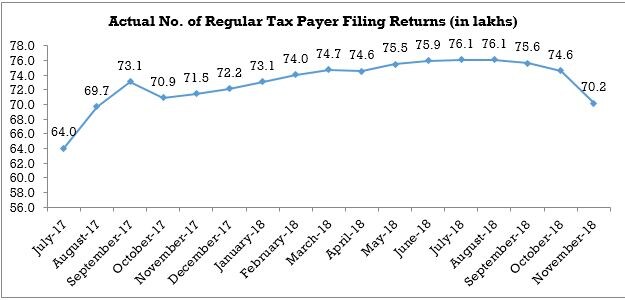

What is even more striking is that this has happened despite a significant increase in the number of entities that have registered under GST. In fact, a look at the absolute numbers shows that while the number of entities filing returns increased till September 2018, it has been declining thereafter, with the sharpest decline witnessed in November 2018.

So much so, the figure for November 2018 is only marginally higher than what it was in August 2017, i.e. a month after GST came into operation in July 2017. The fall in compliance could have arisen due to a number of reasons; tax evasion being one important reason. What needs to be kept in mind that the fall in compliance has happened despite various anti-evasion measures, such the e-way bill introduced in June 2018 all over the country, being put in place. The trend so far also reflects that such tax evasion measures have not been very successful so far.

Source: Calculated using un-starred question number 4063, Lok Sabha, 4 January, 2019

Given these factors, the forecast of GST revenue growing such a high rate and at a much higher rate than all other components of taxes is rather surprising. While one might argue that there is nothing unusual about revenue forecast being ambitious, the point however is that in a climate where keeping the fiscal deficit within tight reins is seen as the most important priority of the government, a large shortfall in revenue has implications for government spending, particularly in social sectors where it is most needed at this juncture.

4 February, 2019

4 February, 2019