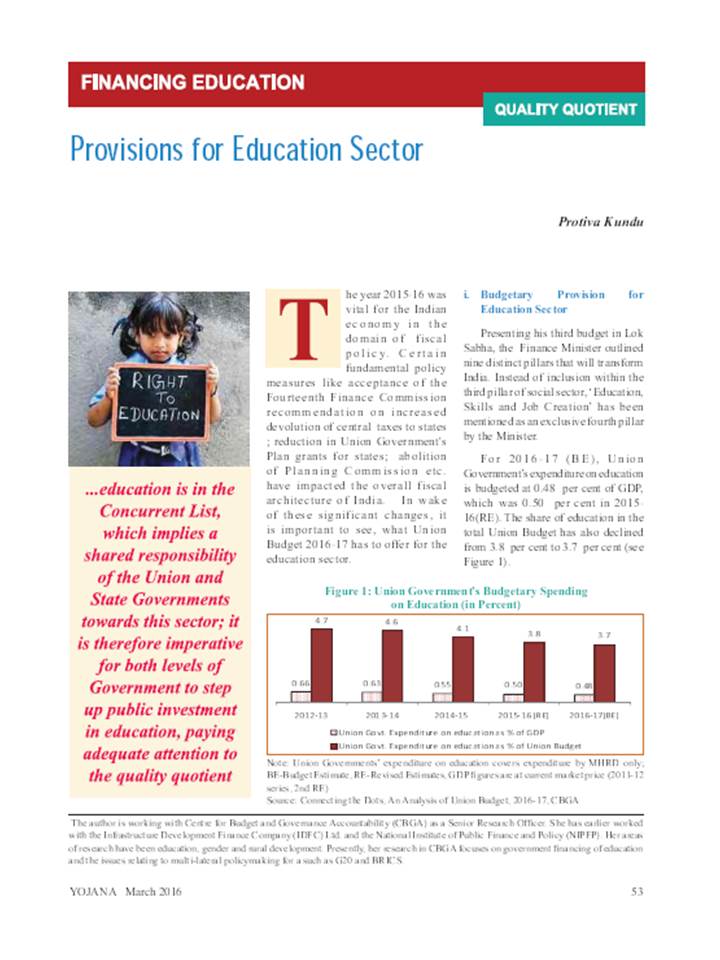

Revenue Mobilisation Efforts and the Budget 2017-18

India’s tax structure is regressive with nearly two-third of total tax collected (taking into account tax collections of both the Centre and the States) being accounted for by indirect taxes. Since the Central government collects most of the direct taxes, in general the tax structure of the Central government tends to be more progressive.