Earth’s temperature has risen by an average of 0.14° Fahrenheit (0.08° Celsius) per decade since 1880, or about 2° F in total. The rate of warming since 1981 is more than twice as fast: 0.32° F (0.18° C) per decade. 2022 was the sixth-warmest year on record based on National Oceanic and Atmospheric Administration’s temperature data. As the world prepares to stop this climate change catastrophe through limiting global warming to 1.5 to 2 degrees Celsius, countries are placing fiscal policy measures like carbon pricing at the centre of their mitigation strategies. Reducing greenhouse gas (GHG) emissions is the need of the hour and adding a tax to limit the amount of emissions could be a significant way to proceed. Carbon dioxide and other GHGs cause negative externalities (indirect costs to individuals and society) that are not sufficiently priced into the market. These un-priced externalities are unevenly distributed across economic sectors and regions, leading to continued capital flow to high GHG emitting and cheaper fossil fuels. Governments are enforcing a price on carbon by using instruments including carbon taxes, compliance markets, reducing fossil fuel subsidies, internal carbon pricing and carbon border tax adjustments. Around 26 countries have adopted carbon tax so far besides other implicit carbon pricing mechanisms.

India does not have an explicit carbon pricing mechanisms like carbon tax, though it does have an array of schemes and implicit taxation mechanisms that put an implicit price on carbon, such as Coal Cess, Perform Achieve Trade schemes and Renewable energy certificates.

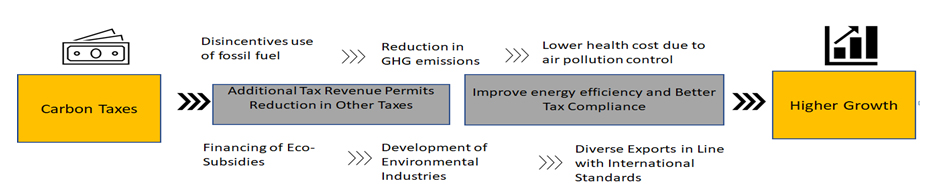

Explicit carbon tax policy if adopted by India can complement some of the gaps associated with implicit pricing mechanisms in terms of limiting carbon emissions at its source, that is, disincentive to fossil fuel consumption and reducing complexity in tax implementation. Carbon taxes are explicit price instruments since they set a price rather than an emission limit. The carbon taxes can also raise additional revenues for the government which can then be used towards emission reduction environment protection objectives and help in the country’s economic growth. Carbon taxes can have a positive impact on growth on the non-tax (as tax is not directly levied on the people) revenues of the centre and state governments. A carbon tax is a non-tax revenue source —a tax on a transaction—as opposed to a direct tax, which taxes income. The figure below depicts three channels that may lead to better growth, which are (a) lower health management costs, (b) Better tax compliance and (c) promotion of environmental industries through financing of eco-subsidies[a]. It encourages firms to adopt sustainable technologies to reduce carbon footprint which can also deliver long term economic and environmental benefits.

Figure 1- Explicit Carbon tax policy benefits for low carbon growth

Source: Author’s adoption from a Discussion Paper on Carbon Tax Structure for India. New Delhi: Shakti Sustainable Energy Foundation

The coal cess introduced in 2010, is often seen as being equivalent to a carbon tax. The reason being that key purpose of this cess was to finance and promote clean energy initiatives and fund research around clean energy through its transfer to a dedicated National Clean Environment and Energy Fund (NCEEF). The coal cess had its share of problems, such as un-utilisation of funds in the NCEEF. Owing to lack of proper guidelines and purpose for its utilisation and with the introduction of the Goods and Services Tax (GST) in July 2017, the cess was subsumed under the GST compensation cess. This had led to a re-prioritisation of the use of coal cess revenues for general purposes.[ii]

Several analysts assessed the implicit carbon pricing mechanism in India like the Perform Achieve and Trade scheme and Renewable Energy Certificate scheme being implemented since 2012. There are several issues reported with the implicit carbon mechanism operational in India. Some of the issues are - lenient targets, no penalties on non- compliance of target, excessive supply of trade-able certificates leading to reduced price of certificates. [iii] Furthermore, India specific analysis under OECD study suggests that an implicit form of carbon pricing covers 54.7% of emissions which has remained unchanged since 2018. Fossil fuel subsidies cover 2.5% of emissions in 2021.[iv] This study determine Net Effective Carbon Rates (ECR)which summarise how countries price carbon through fuel excise taxes, carbon taxes , emission trading systems. Net effective carbon rates are highest in the road transport sector, which accounts for 8% of the country's total GHG emissions.

It should be noted that simply abiding by the polluter pays principle it is very difficult to put a price on the carbon. Carbon tax can be used to reduce the negative impact of excess carbon emission in the environment, but such a tax can also have a negative impact on the economy of that nation. This tax may lead to unstable revenue streams when the economy shifts to low-carbon alternatives. This is a real concern if an economy has an elastic demand for fossil fuels, though less so in jurisdictions where demand is inelastic [v].A thorough review of possible regressive impact of carbon tax in Indian context is required before its imposition. The demand for energy for cooking and lighting is increasing rapidly in India. A study on Economic, Sustainable Development, and Fuel Consumption emphasises on the economic, sustainable development, and fuel consumption of the Indian household [vi].

One solution to reduce the adverse impacts of a carbon tax could be recycling carbon tax revenue. Governments can make use of the revenue received from the tax and provides a channel for the government to return the capital to the society. The revenue earned can be used to support renewable energy, energy efficiency projects and efficient transportation projects. However, a massive political trust needs to be in place if any such scheme is to work efficiently. Also, proper accounting needs to be done as to how the fund would be used by the government and consensus needs to be built with consent from different tiers of the government to make it more inclusive.

References

[i] Young, E.L., 2018. Discussion Paper on Carbon Tax Structure for India. New Delhi: Shakti Sustainable Energy Foundation Address. https://shaktifoundation.in/wp-content/uploads/2018/07/Discussion-Paper-on-Carbon-Tax-Structure-for-India-Full-Report.pdf

[ii] Aaqib Ahmad; Mishra, Prajna Paramita (2019). Evaluating the performance of carbon tax on green technology: evidence from India. Environmental Science and Pollution Research, (), –. doi:10.1007/s11356-019-06666-x https://link.springer.com/article/10.1007/s11356-019-06666-x

[iii] Sarangi, G. K. and F. Taghizadeh-Hesary. 2020. Unleashing Market-Based Approaches to Drive Energy Efficiency Interventions in India: An Analysis of the Perform, Achieve, Trade (PAT) Scheme. ADBI Working Paper 1177. Tokyo: Asian Development Bank Institute. Available: https://www.adb.org/publications/unleashing-market-based-approaches-driveenergy-efficiency-interventions- india

[iv] OECD, Pricing GHG emissions, India, Country Notes 2021 https://www.oecd.org/tax/tax-policy/carbon-pricing-india.pdf

[v] Prasad, M., 2022. Hidden benefits and dangers of carbon tax. PLoS Climate, 1(7), p.e0000052.

[vi] Maheshvari, R., 2022. Study on Economic, Sustainable Development, and Fuel Consumption. ASEAN Journal of Economic and Economic Education, 1(1), pp.41-46. https://ejournal.bumipublikasinusantara.id/index.php/ajeee/article/view/104

7 June 2023

7 June 2023